Hyperliquid Is What Happens When Trading Becomes the Product

Most DEXs retrofit trading onto general-purpose chains. Hyperliquid inverts the stack by designing a layer where orderbooks, clearing, and perps are protocol primitives.

When it comes to performance, precision, and reliability, most DEXs fall short. The real issue is not that DEXs are bad. It’s that they were never designed like trading systems in the first place.

Instead of building for execution from the ground up, most protocols simply added trading features onto chains meant for everything else. The results worked well enough for slow markets, but cracked when speed and fairness actually mattered.

Hyperliquid is the opposite of that approach.

The Evolution of Onchain Trading

Before Hyperliquid, onchain trading evolved in stages. Each phase solved one problem while introducing new ones.

The AMM Era

Protocols like Uniswap and Curve popularized automated market makers. These systems made trading possible without orderbooks or counterparties. Liquidity was always available, thanks to simple math-based formulas.

But AMMs had limits.

High slippage on large trades

Impermanent loss for LPs

No native leverage

No real-time execution

This made them easy to use but unsuitable for active or professional traders.

The Perp DEXs

Projects like GMX and dYdX brought perpetual swaps to DeFi. They introduced leverage, margin, and orderbook-based trading.

However, they made tradeoffs to get there:

dYdX ran its matching engine off-chain, relying on a central sequencer

GMX simplified execution through virtual liquidity and price oracles

Most systems needed external keepers to liquidate positions

These designs worked under normal conditions, but failed during volatility.

Off-chain coordination introduced delays. Oracles could be manipulated. Keepers missed liquidations or front-ran them.

The Latency Wall

The biggest gap was execution latency. Centralized exchanges finalize trades in milliseconds. Onchain systems often take seconds, or longer.

Even with high throughput, most blockchains separate consensus (ordering transactions) from execution (applying state changes). This separation adds time, introduces mempools, and opens the door for manipulation.

No onchain system combined:

Fast, deterministic execution

Verifiable settlement

Full transparency without off-chain logic

Until Hyperliquid.

Founders, Mission, and Right to Win

Why would anyone build a trading chain from scratch?

Most teams building DEXs today start with a general-purpose chain like Ethereum or Solana, then add smart contracts for trading logic.

That works if your goal is simple swaps or passive yield. But it breaks when you need precision, speed, and total control over how trades settle.

The team behind Hyperliquid took the opposite route. They didn’t ask “how can we launch fast on an existing chain?”

They asked “what would a trading system look like if it were a blockchain?”

Who’s building it?

Hyperliquid was founded in 2023 by Jeff Yan and Iliensinc. The two founders come from deep quantitative and high-frequency trading backgrounds.

They studied at Harvard, Caltech, and MIT. Before Hyperliquid, they worked on execution systems at Chameleon Trading and Citadel.

This matters because designing a trading-first chain is a very different problem than building a general smart contract platform. It requires thinking like an exchange operator, not an app builder.

Key traits of the founding team:

Full-stack infra experience (not just Solidity devs)

Deep understanding of matching engines, latency, and real-world trading behavior

Strong culture of systems-level engineering

No venture capital or external control

Bootstrapped and user-owned

Hyperliquid didn’t raise from VCs. Instead, it launched with a fairdrop. The team took no initial token allocation. There were no insider presales or seed rounds.

All protocol fees flow into automatic buybacks of the native token, $HYPE. This creates direct alignment between usage and token value, without relying on grants or inflation.

Built to win one use case

Hyperliquid is not trying to be a universal DeFi platform. It does not support random smart contracts or yield farming systems. It focuses on one job: enabling high-performance, trustless trading.

This specialization allows for deep optimization in places most chains can’t touch:

Consensus is custom-built for trading

Validators run embedded matching engines

Vault logic is handled at the protocol level

Where most chains abstract away infrastructure, Hyperliquid owns it end to end.

Architecture from the Ground Up

What makes Hyperliquid different under the hood?

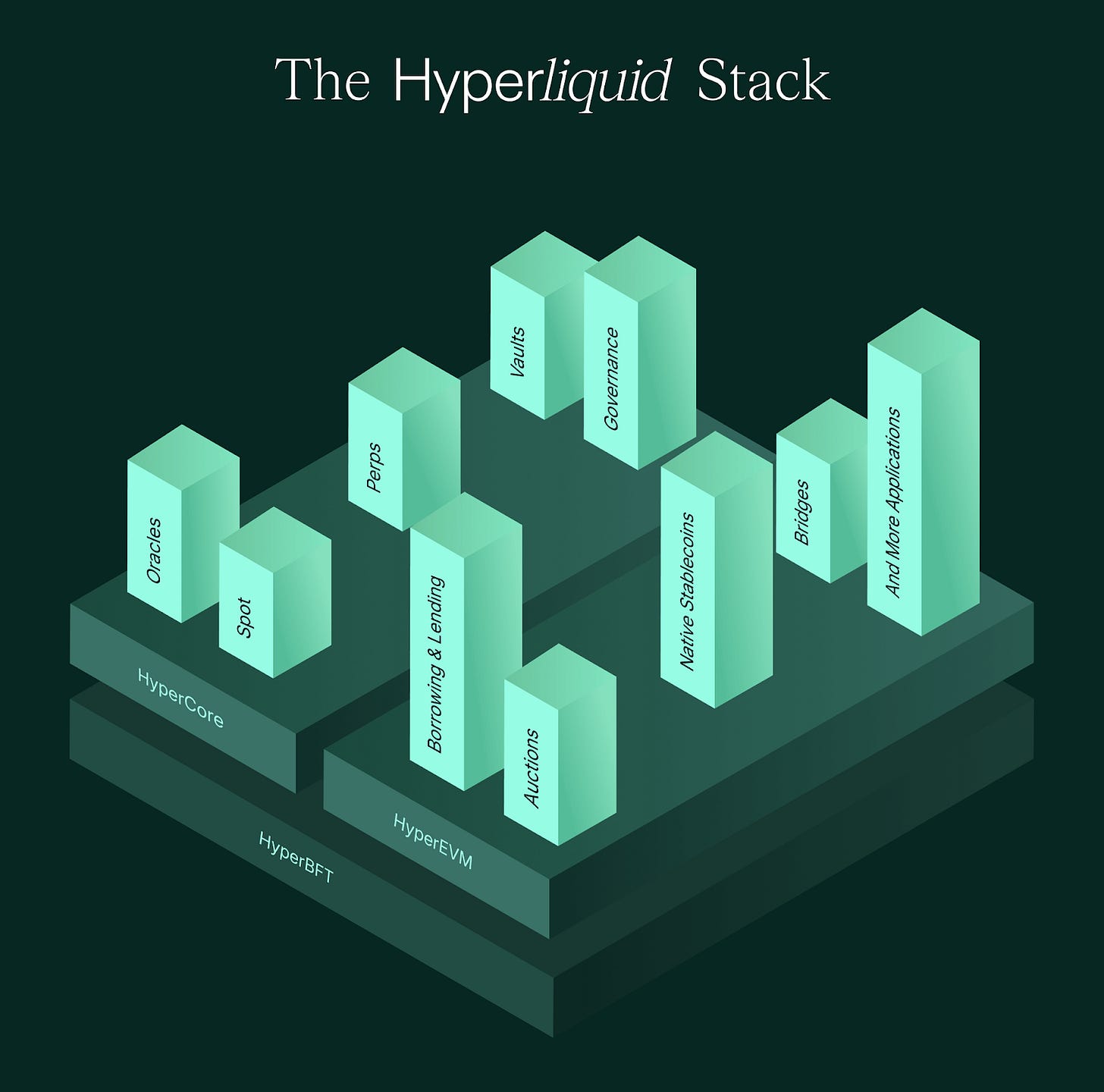

Hyperliquid is not a fork of an existing chain. It is a custom-built Layer 1 that collapses consensus, execution, and trading logic into a single system. There is no separation between the base chain and the exchange. They are the same thing.

This architecture is what gives Hyperliquid its performance and determinism. Every part of the stack is designed to remove delay, eliminate coordination failures, and support trustless execution.

Let’s break it down.

HyperCore: A Trading-Centric Layer 1

Hyperliquid runs on its own blockchain called HyperCore. It does not rely on Ethereum, Cosmos, or any shared execution environment.

Key design principles:

Built from scratch to support real-time trading workloads

No blobstream or external data availability layers

All trades, vault updates, and system actions are written directly into blocks

Every validator participates in full-state simulation

This full-state inclusion model allows the chain to act like a ledger and a trading engine at once.

HyperBFT: Fast Finality with Embedded Execution

Consensus in Hyperliquid uses a custom variant of HotStuff called HyperBFT.

Most BFT protocols only order transactions. HyperBFT goes further. It requires validators to simulate execution during the consensus process. A block is only accepted if all validators produce the exact same post-state.

Why it matters:

There is no mempool. Transactions are either in a block or ignored.

No reorgs or forked states. Finality is deterministic.

Latency stays under one second, even during stress.

Liquidations and funding updates happen as part of consensus, not afterward.

HyperBFT ensures that every block contains a complete state transition, not just a list of ordered actions.

Performance at Exchange Scale

Hyperliquid is designed to support the types of workloads typically seen on centralized exchanges.

Benchmarked at 20,000 to 200,000 operations per second

Finality in 100 to 900 milliseconds

No degradation under volatile conditions

All vault, order, and trade data stored on-chain

By handling everything internally, order flow, settlement, margin tracking, the protocol removes any reliance on third-party tools or off-chain systems.

HyperEVM: Composability Without Chaos

HyperEVM adds smart contract capabilities to Hyperliquid.

Unlike most chains, HyperEVM does not allow arbitrary contracts. Instead, it supports programmable vaults, LP strategies, and automation logic that can safely integrate with the core execution engine.

Features:

Strategy vaults with on-chain performance tracking

Arbitrage bots that run natively with gasless execution

No gas auctions or bidding wars

Contracts operate within bounded state transitions defined by the protocol

This allows Hyperliquid to stay composable for trading strategies, without opening up to execution spam or unknown behaviors.

Perpetual Trading as a Protocol Primitive

How does Hyperliquid handle perps without smart contracts?

Most DEXs implement perpetual swaps through external contracts or hybrid systems. Some use virtual AMMs.

Others run matching engines off-chain. Almost all rely on keepers or bots to handle liquidations and funding. Hyperliquid skips all of that.

It embeds every core component of perp trading directly into the protocol. This means order matching, PnL calculation, liquidation logic, and funding flows are enforced by the chain itself, not by apps running on top of it.

Let’s understand each system.

Clearing House: Cross-Margin by Default

Hyperliquid runs a protocol-native clearing house. This system manages open interest, collateral, and leverage across every trader and vault.

Key features:

Cross-margin support: Traders can deploy funds across multiple positions without manually managing collateral per market

Up to 50x leverage: Controlled by vault-defined risk limits

Real-time PnL and risk calculations: Updated every block by validators

No gas or composability risk: All changes are enforced inside consensus

Compared to dYdX or GMX, this removes the need for position management contracts or off-chain risk engines.

On-Chain Matching: Full Orderbook, No Mempool

Most chains cannot support orderbooks natively. Hyperliquid does.

Its matching engine is embedded in the consensus path. Every validator rebuilds and verifies the orderbook in-memory, with strict price-time priority.

Design properties:

No off-chain sequencer: All matching happens inside validator execution

No frontrunning: Transactions have no tip priority and no mempool visibility

Gasless orders: Traders post and cancel orders without fees

Deterministic fills: Every match is replayable and auditable by the network

This gives Hyperliquid the behavior of a centralized exchange without the trust assumptions.

Oracle System: Fast and Internal

Hyperliquid does not depend on Chainlink, Pyth, or any external oracle aggregator. It maintains an internal, high-frequency oracle system that runs inside the protocol.

Feeds price into funding rate, margin requirements, and liquidations

Uses short TWAP windows to reduce manipulation

Updated each block, not every few minutes

No third-party dependency

This tight integration gives traders and vaults predictable behavior and removes the risk of stale or missing prices.

HLP Vault: Protocol Market Counterparty

Every market in Hyperliquid is backed by a native liquidity vault called HLP.

Single-sided LP vault: Users deposit one asset and gain exposure to fees

Counterparty to trades: Absorbs trader PnL and earns taker fees

Funding payments flow to HLP from open interest imbalance

Liquidation proceeds are returned to HLP to offset losses

This system is similar to GMX’s GLP, but with one key difference: it runs entirely inside protocol logic. Vaults are never drained due to contract bugs, delayed execution, or bad risk modeling.

Strategy Vaults: Permissionless and Programmable

On top of HLP, traders can deploy custom vaults that follow specific strategies.

Signal-based or passive trading

Performance fees paid to vault operators

Logic written in HyperEVM but bounded by protocol rules

No access to global state outside of allowed vault paths

These vaults can follow momentum, arbitrage, or mean-reversion strategies. Because execution happens natively, latency remains low and outcomes are deterministic.

Liquidations: Instant and Embedded

Most DEXs rely on bots to liquidate unhealthy positions. These bots often race each other, miss opportunities, or game the system. Hyperliquid removes them entirely.

Every validator checks margin status each block

If a vault or trader breaches margin, liquidation is enforced immediately

Rewards go directly to the protocol or vault executor

No competition, no delay, no external gas payment

This results in faster, fairer liquidations and a healthier system under stress.

Funding: Synchronized and Stable

Perpetuals need a funding rate to keep prices in line with spot. Hyperliquid handles this internally, using per-block funding flows based on long-short imbalance.

Mechanics:

Funding calculated hourly

Flows directly between long and short positions

Index price derived from internal oracle, not external feeds

Funding payments are enforced by the chain, not bots

This reduces noise, prevents manipulation, and ensures price alignment stays tight.

Fee Model: Simple and Aligned

There is no tipping or priority gas market. Instead, Hyperliquid runs a flat fee system:

Taker fee: 2.5 basis points

Maker rebate: –0.2 basis points

Ninety-seven percent of fees are used to buy and burn $HYPE

No MEV, no bribing, no auctioning of order flow

This creates a smooth UX and ensures the protocol remains fair, even at high volumes.

Spot Markets and Protocol Expansion

Can the same engine handle spot trading?

Most DEXs specialize in either spot or perps, rarely both.

Hyperliquid takes a different approach by using the exact same infrastructure for spot markets as it does for perps.

There’s no separate product line or additional contracts. The engine is unified.

Spot Market Mechanics

CLOB-Based Matching: Just like perps, all spot trades follow strict price-time priority using a native orderbook.

Gasless UX: Posting, modifying, or canceling orders requires no gas fees.

Deterministic Settlement: Once a block is finalized, trades are final. No risk of reorgs or mismatched state.

On-Chain Data: Every spot trade, order update, and vault balance change is written directly into L1 blocks.

This creates a CEX-like trading experience without any trust assumptions or off-chain dependencies.

Governance of Spot Markets

To avoid spam listings or inactive tokens, asset approvals are managed via on-chain governance:

HIP-1: Determines which assets get listed.

HIP-2: Coordinates initial liquidity auctions.

Community Voting: Token holders participate in listing proposals.

Listing Transparency: All approvals and vote outcomes are verifiable on-chain.

This setup ensures quality control without relying on centralized gatekeepers.

Real World Impact

For users, this means:

Reliable spot trading with tight spreads

Transparent order flow and matching

Access to new tokens via community-led listings

Gas-free execution even in volatile markets

Hyperliquid spot markets feel like a centralized exchange but with protocol-level guarantees.

Where Things Stand: Adoption and Metrics

Since its launch, Hyperliquid has gained traction fast. Not just from retail traders, but from LPs, vault builders, and high-frequency trading firms. As of July 5, 2025, the protocol has reached ~$421 million in TVL.

It has processed over ~$1.82 trillion in total volume, with ~$88 billion in total deposits and ~$84 billion in withdrawals.

Over ~526K users have interacted with the system, showing broad participation across retail and institutional profiles. More than 2,700 vaults have been created by users and protocol actors, reflecting real demand for programmable strategy infrastructure.

The Hyperliquidity Provider (HLP) vault alone holds ~$373 million, making it one of the most heavily utilized onchain market-making systems built directly into protocol logic.

These numbers show consistent use, high capital efficiency, and protocol-level capture of value, all while preserving transparency and fairness.

The stats are sourced from here.

The New Standard of DeFi

Hyperliquid doesn’t need to try to improve DeFi or integrate with existing chains. Rather, it’s trying to rebuild it from scratch around one core principle: trustless execution that actually performs.

It strips away the patchwork layers with no external sequencers, dependency on off-chain bots, or smart contracts built on top of unfriendly base layers.

Instead, it gives traders an execution environment they can rely on, a protocol they can verify, and a fee structure that rewards users and not middlemen.

What comes next is not about hype. It is about whether the rest of DeFi is ready to treat execution infrastructure as seriously as the apps built on top of it.

Hyperliquid already has.

This article was written by Uddalak Das (@ninja_writer21), based on public information as of June 2025. It is an independent analysis of Hyperliquid’s architecture, trading model, and protocol design with no affiliation or input from the Hyperliquid team.